top of page

TRENOS SiGINT: Towzen Sydney & Global Ramen Logic

Towzen opening in Sydney reflects a broader pattern in Japanese food exports that it's category integrity first, localisation second. Unlike Western fast-casual rollouts, Towzen preserves core broth philosophy, soy-milk base, mushroom-forward umami, overnight stocks, while flexing flavour architecture for multicultural markets. The result is credibility, not cosplay.

Scott Mathias

4 days ago2 min read

TRENOS SiGINT: ALDI £1.99 Plant-Based Play Rewrites the Veganuary Rulebook

ALDI has expanded it's Plant-Based Menu range reflecting a clear shift in how plant-based growth is being engineered in mass retail. Instead of leaning on innovation theatre or sustainability messaging, the retailer is using price discipline and private label scale to reduce friction for first-time and returning plant-based buyers. At £1.99, these products undercut much of the branded meat-free aisle, reframing plant-based as a default option rather than a lifestyle choice.

Scott Mathias

Dec 15, 20252 min read

TRENOS SiGINT: If Breast Milk Changes in 6 Days, What’s Meat Doing to Your Blood in 6 Hours?

A controlled feeding trial in lactating mothers demonstrated that switching from beef to a plant-based meat analogue rapidly altered breast milk fatty acids (↑ medium-chain SFAs, ↓ long-chain PUFAs including ARA). This rapid biological response signals broader implications: if a single dietary swap can alter milk composition in under a week, then continuous consumption of animal meat is almost certainly reshaping adult blood lipid profiles daily, through mechanisms already do

Scott Mathias

Dec 8, 20252 min read

TRENOS SiGINT: Plant-Based Yogurt Surges as ANZ Brands Feel the Squeeze

Global plant-based yogurt demand is expanding at a steady 9.2% annual growth, led by gut-health trends and the normalisation of dairy-free products in mainstream retail. Coconut yogurt remains one of the strongest textural performers, but ANZ brands like Raglan (NZ), COYO (AU), and Coco Bella (AU) operate with a strategic disadvantage: total reliance on imported coconut cream and milk from Thailand and Sri Lanka.

Scott Mathias

Nov 27, 20252 min read

TRENOS SiGINT: Murni Gives Aussie Plant-Based a Reset

Murni signals a structural pivot in Australia’s plant-based landscape: a return to whole-food proteins that can scale without the emissions, cost structures, and cold-chain fragility that sank the last wave of over-processed plant-based brands. Shelf-stable tempeh is a category unlock — low-energy, low-waste, culturally grounded, and immediately viable for retail, meal-kits, canteens, aged care, and regional stores that previously couldn’t handle chilled alt-protein.

Scott Mathias

Nov 18, 20252 min read

TRENOS SiGINT: UK’s Plant-Based Pulse Is Back - From Chickpea Tofu to Cauli Gnocchi

The UK’s plant-pulse wave signalled a maturing, stabilising plant-based market. Category leaders like BOSH!, THIS™, and BOL are repositioning around nutrition, convenience, and taste credibility. Supermarkets are embracing frozen and chilled SKUs with strong functional benefits, a move from “alternative meats” toward whole-food, vegetable-first innovation. These signals show an industry re-setting for longevity using simpler ingredients, cleaner labels, and formats that norm

JC - Analyst

Oct 8, 20252 min read

TRENOS SiGINT: United States Meat Alternatives Market (2025)

The signal isn’t “boom or bust”, it’s portfolio fitness. Headline numbers on the global market remain bullish to 2031, while the United States meat alternatives retail is pruning chilled sets and nudging shoppers toward frozen, value, and flavour-first formats. M&A (Loma Linda/Tuno), rebrands (Beyond→“Beyond”), and new chicken lines (JUST Meat) show operators chasing taste, price, and convenience over ideology. Expect more blended, cleaner-label, and channel-specific plays a

JC - Analyst

Sep 17, 20251 min read

TRENOS SiGINT: Malaysia Airlines Plant-Based Satay

Malaysia Airlines has added a fully plant-based satay made from Lion’s Mane mushroom to its Business Class and Business Suite offering. The product preserves the airline’s famous cucumber and onion marinade and side accompaniments, extending inclusivity without sacrificing tradition. This is a strong signal of how mainstream plant-based proteins are becoming in high-value travel markets.

JC - Analyst

Sep 6, 20251 min read

TRENOS SiGINT: Sri Lanka’s Miditer Goes Vegan at Fine Food Sydney

Miditer is taking Sri Lanka’s food story beyond coconuts and dried fruit. At Fine Food Australia in Sydney (8–11 Sept), the brand will showcase new vegan FMCG lines alongside its heritage fruit and nutraceutical exports. This marks a bigger signal as Sri Lanka edges away from commodity-driven exports and into value-added, plant-based consumer goods that can sit comfortably on supermarket shelves from Sydney to San Francisco.

JC - Analyst

Sep 5, 20251 min read

TRENOS SiGINT: Alt-Meat Market Forecast 2034

Global market size for alt. plant-based meat is expected to cross USD $35B by 2034, with growth driven by ingredient optimisation, regional regulation shifts, and institutional buy-in. Retail slowdown masks deeper structural adaptation and new B2B opportunity layers. (Source Here)

JC - Analyst

Sep 3, 20251 min read

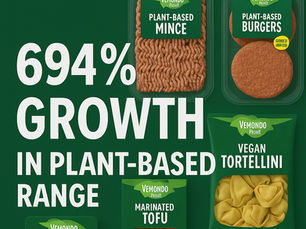

TRENOS SiGINT: Lidl GB and Its 700% Plant-Based Growth

Lidl UK and its near-700% (694%) increase in plant-based sales marks a consumer reset from niche veganism to mainstream pantry choice. The trend is shifting from meat analogue hype to everyday affordability, powered by tofu, pulses, and low-priced branded staples. Lidl’s playbook, price accessibility plus nutritional credibility, creates a blueprint for other UK retailers facing scrutiny over health and sustainability targets.

JC - Analyst

Sep 3, 20251 min read

TRENOS SiGINT: Indian Planet-Based Burgers - Shandi Global

The Shandi Global trajectory signals a powerful trend - Indian-rooted innovation, incubated in Singapore, is now shaping the global plant-protein market. What began as parental frustration with one underwhelming burger is morphing into a scaled, science-driven enterprise tackling affordability, nutrition, and protein access at mass-market levels.

JC - Analyst

Aug 26, 20251 min read

TRENOS SiGINT: Oscar Mayer's 'EveryBun Pack' Test

Oscar Mayer’s 'EveryBun Pack' signals a major packaging pichange - appeasing flexitarian households without forcing blended compromises. By sealing meat and vegan dogs together in one tray, Kraft Heinz is acknowledging dual appetites in the same kitchen, betting on convenience as the mediator.

JC - Analyst

Aug 21, 20252 min read

TRENOS SiGINT: Pricing Eases, Functional Plant-Based Booms Ahead of Plant Based World North America

Plant-based retail is heading into Plant Based World North America with a market tailwind. U.S. CPI for food has fallen from 10.1% in January 2023 to 2.6% in February 2025, while average plant-based shelf prices have flipped from +10.5% YoY to –3.8% YoY. This shift signals easing pricing pressure and room for value-driven growth strategies. Data-Spins Satori, 2025

JC - Analyst

Aug 15, 20251 min read

TRENOS SiGINT – NZ Plant-Based Market Contraction- Bean Supreme

Bean Supreme, one of New Zealand’s oldest plant-based protein brands, is exiting the market amid significant downturn in consumer demand. Owner Life Health Foods confirms production will cease by July 2025, marking another retreat in New Zealand’s shrinking alt-protein sector. Post-Covid pressures, investor fatigue, and a worsening cost-of-living crisis have shifted buying behaviour, with consumers reverting to traditional meat despite price parity or advantage in some plant-

JC - Analyst

May 13, 20251 min read

bottom of page